Forum Replies Created

-

AuthorPosts

-

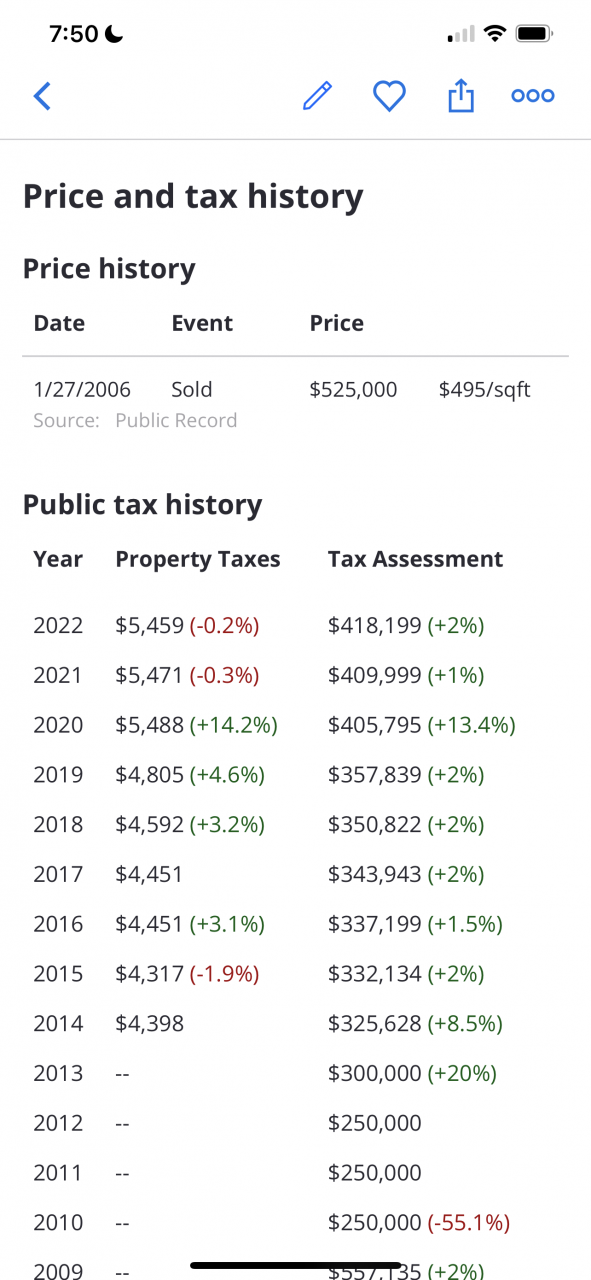

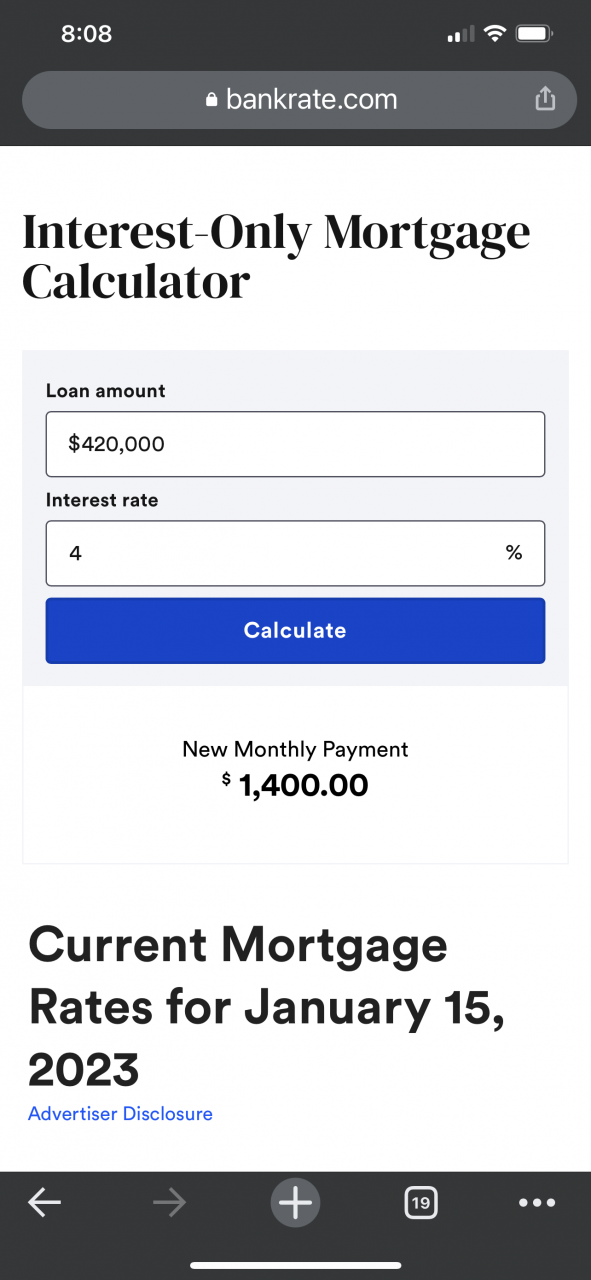

Not so fast. As Rob stated they invested 110k and financed 420k. Interest only at 4% would be 1,400 per month, 16,800 a year. 5,000 a year property tax would bring that to 21,800 per year. Now I know Jon was paying 1,800 per month back in 2010. I seriously doubt that hasn’t gone up since but let’s just use that number. So between Jon’s rent and CSS water that’s 3,600 per month 43,200 per year. That’s a profit of 21,400 per year. 17 years later that’s a profit of 363,800 profit. Not to mention the tax benefits they received and all the free labor provided by club members to improve the property.

If it’s true that the owners of the ranch did this to help the club and in no way expected to make profits then the club should be able to purchase the ranch cheap at this point. Considering the rental income and the water income the ranch has received over the last 10 years I would guess they have recouped a large portion of their investment. So if their intentions were to save the LZ they should sell the ranch to the club at a price that would make them break even not market value.

SOLD

SOLD!

Delete

-

AuthorPosts